Texas Wildfire Risks: Understanding the Current Crisis

Texas wildfire risks have escalated dramatically, especially highlighted by the recent Smokehouse Creek Fire, which stands as the largest wildfire in the state’s history. As this fire was declared nearly contained, experts warn that remaining conditions could lead to further outbreaks, emphasizing the volatility of climate-related risks in Texas. The interplay of extreme weather patterns, such as droughts and unusual storm systems, is contributing to the rising frequency and intensity of wildfires, necessitating robust insurance and wildfire strategies. Furthermore, the role of government in modernizing building codes Texas and implementing effective disaster mitigation measures cannot be understated. As we navigate these challenges, understanding the intricate dynamics between climate, infrastructure, and insurance becomes paramount in safeguarding communities from future fire threats.

The threats posed by wildfires in Texas are increasingly becoming a pressing concern for residents and policymakers alike. The phenomenon, often exacerbated by climate variability, showcases the urgent need for effective fire prevention measures and resilient building practices. Stakeholders must engage in a comprehensive dialogue regarding the interplay of insurance, government policies, and community preparedness to address these fire hazards. As Texas grapples with these environmental challenges, the emphasis on adapting building regulations and enhancing infrastructure resilience is critical. In light of these developments, recognizing the broader implications of wildfire threats on public safety and economic stability is essential.

Understanding Texas Wildfire Risks

The state of Texas has been grappling with increasingly severe wildfire risks, highlighted dramatically by events like the Smokehouse Creek Fire. This fire, which has been labeled the largest in Texas history, underscores the urgent need for improved fire management practices and a better understanding of the environmental factors contributing to such catastrophic events. Factors such as prolonged drought, high winds, and rising temperatures, all exacerbated by climate change, create a perfect storm for wildfires. Consequently, Texas residents and policymakers must address these escalating risks by adopting proactive measures to mitigate potential disasters.

In addition to environmental factors, the infrastructure’s resilience to wildfires plays a crucial role. Power lines and utility equipment that are not built to withstand extreme weather conditions can ignite fires, as evidenced by the Smokehouse Creek Fire’s origins linked to Xcel Energy’s equipment. As climate-related risks increase, there is a pressing need for stricter building codes in Texas that prioritize fire safety. Implementing modern construction practices and retrofitting existing structures can significantly reduce vulnerability, ultimately saving lives and property.

The Government’s Role in Mitigating Wildfire Risks

Government intervention is essential in addressing the wildfire risk crisis in Texas. By modernizing building and land-use codes, authorities can establish regulations that require fire-resistant materials and strategic landscaping to create defensible spaces around properties. Furthermore, revising statutes that unintentionally inflate insurance claim costs can alleviate some financial burdens on both insurers and homeowners. This collaborative approach between government and the insurance industry can lead to more robust disaster mitigation strategies.

Moreover, the government has the opportunity to invest in infrastructure that enhances resilience against wildfires. This includes creating firebreaks, managing vegetation in at-risk areas, and improving communication systems during emergencies. Legislative measures aimed at supporting research and funding for wildfire prevention initiatives can further empower communities to respond effectively to potential threats. As seen with recent proposals in Congress, proactive policies can set the groundwork for long-term solutions, but they must be informed by reliable data on wildfire patterns and trends.

Insurance Strategies for Wildfire Preparedness

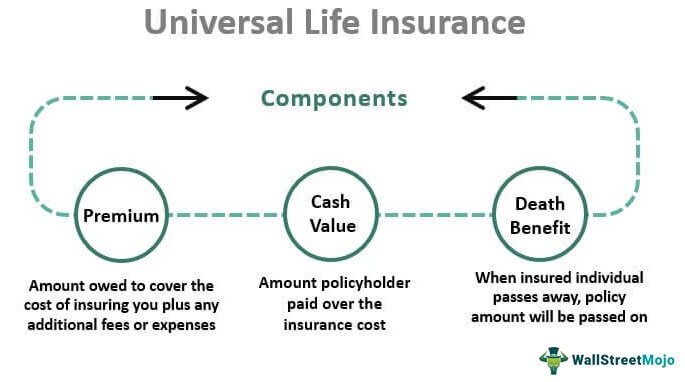

Insurance companies have a pivotal role in wildfire risk management, particularly in Texas, where the frequency and intensity of wildfires continue to rise. Insurers are increasingly incorporating advanced data analytics and modeling techniques to assess risks accurately, ensuring that they can provide adequate coverage and support to policyholders. By understanding the environmental factors that contribute to wildfires, insurers can offer incentives for homeowners to implement fire-resistant measures, effectively reducing their overall risk profile.

Additionally, insurance products tailored for wildfire-prone areas can empower homeowners to take proactive steps in safeguarding their properties. For example, offering discounts for homes equipped with fire-resistant materials or those located within community fire protection plans can incentivize risk-reducing behaviors. As the insurance industry continues to adapt to climate-related risks, collaboration among insurers, homeowners, and local governments will be vital in developing effective strategies for wildfire preparedness and response.

Building Codes in Texas: A Necessity for Fire Safety

The importance of updating building codes in Texas cannot be overstated, particularly in the wake of increasing wildfire threats. Stronger regulations that mandate the use of fire-resistant materials and construction techniques can significantly mitigate the risk of wildfire damage. By adopting modern building practices, Texas can lead the charge in enhancing resilience against wildfires, ensuring that new developments are better equipped to withstand the unpredictable nature of climate-related disasters.

Moreover, existing structures should not be overlooked; retrofitting older buildings to meet contemporary fire safety standards can further protect communities at risk. Local governments must collaborate with fire safety experts to create guidelines that address the unique challenges posed by Texas’s climate. By creating comprehensive fire safety standards and ensuring compliance, the state can better protect its residents and minimize the economic impacts associated with wildfire incidents.

The Interconnectedness of Climate Change and Wildfires

The relationship between climate change and the increasing frequency of wildfires in Texas is becoming increasingly evident. Factors such as rising temperatures, prolonged drought periods, and erratic weather patterns contribute to a higher likelihood of wildfires igniting and spreading. As seen with the Smokehouse Creek Fire, the effects of climate-related risks are not isolated; they reverberate across ecosystems, economies, and communities. Understanding this interconnectedness is crucial for developing effective prevention and response strategies.

Furthermore, the insurance industry must adapt to this evolving landscape by adjusting their underwriting practices to account for the impacts of climate change. This may involve employing advanced analytics to assess property risk based on historical data and projected climate trends. By incorporating these insights, insurers can better prepare for potential losses, ensuring they remain viable partners in risk management as the state navigates a future with heightened wildfire threats.

The Impact of Climate-Related Risks on Insurance

Climate-related risks, such as wildfires, pose significant challenges for the insurance industry, particularly in Texas where events like the Smokehouse Creek Fire have led to a surge in claims. Insurers are increasingly recognizing the need to adapt their pricing models and underwriting practices to reflect the realities of a changing climate. By integrating comprehensive data analysis and risk modeling, insurers can develop more accurate assessments that ensure they are prepared for potential losses.

Moreover, the rising costs associated with climate-related claims necessitate a reevaluation of how insurance products are structured. Insurers may need to collaborate with state officials and local communities to create innovative solutions, such as community-based insurance models that pool resources and share risks. This collaborative approach can help distribute the financial burden of wildfires while promoting resilience among policyholders.

Community Resilience Efforts Against Wildfires

Building community resilience against wildfires is vital, particularly in Texas, where the risk of catastrophic fires is on the rise. Community engagement and education play a crucial role in equipping residents with the knowledge needed to protect their homes from wildfires. Initiatives that promote defensible space around properties, community fire drills, and educational workshops can empower citizens to take proactive measures in reducing their wildfire risk.

In addition, local governments can foster resilience by collaborating with residents to develop comprehensive wildfire action plans. These plans should include strategies for emergency preparedness, evacuation routes, and recovery efforts post-wildfire. By prioritizing community involvement and resource allocation, Texas can build a more resilient population equipped to face the challenges posed by increasing wildfire threats.

Leveraging Data for Wildfire Risk Management

In the fight against wildfires, leveraging data is essential for effective risk management. Advanced analytics can provide insights into fire behavior, environmental conditions, and risk assessments, enabling better decision-making for both insurers and homeowners. Companies like Whisker Labs are already utilizing sensor networks to monitor fire risks and power grid vulnerabilities, demonstrating the potential of technology in preventing future disasters.

Moreover, the insurance sector can benefit from data-driven approaches to refine their underwriting processes. By analyzing historical wildfire data and predictive modeling, insurers can create tailored coverage options that address the unique needs of property owners in high-risk areas. This not only enhances the insurers’ ability to manage risk but also empowers homeowners to make informed decisions regarding their fire safety measures.

Collaborative Approaches to Wildfire Risk Reduction

Tackling the wildfire risk crisis in Texas requires a collaborative approach that includes government, insurers, and communities. By working together, these stakeholders can develop comprehensive strategies that address the multifaceted nature of wildfire risks. For instance, joint initiatives that promote fire safety education, improved building codes, and enhanced emergency response plans can create a unified front against wildfires.

In addition, partnerships between the insurance industry and local governments can lead to innovative solutions for risk assessment and management. By sharing data and resources, these entities can foster a culture of resilience that empowers communities to take proactive measures in fire prevention. Ultimately, a collaborative framework will not only enhance wildfire preparedness but also strengthen Texas’s overall resilience against climate-related risks.

Frequently Asked Questions

What are the primary Texas wildfire risks associated with the Smokehouse Creek Fire?

The Smokehouse Creek Fire exemplifies significant Texas wildfire risks, including extreme weather conditions, drought, and the presence of dry vegetation. These factors create a highly flammable environment, making it easier for wildfires to ignite and spread. Understanding these risks is crucial for residents and policymakers to enhance wildfire prevention strategies.

How do climate-related risks in Texas contribute to wildfire incidents?

Climate-related risks in Texas, such as prolonged droughts and increased temperatures, significantly heighten the likelihood of wildfires. These environmental changes lead to conditions that are conducive to fire outbreaks, making it essential for homeowners and local governments to implement effective mitigation measures.

What role does insurance play in managing wildfire risks in Texas?

Insurance plays a critical role in managing wildfire risks in Texas by providing financial protection against loss. However, the increasing frequency and severity of wildfires prompt insurers to adapt their underwriting and pricing strategies to reflect the changing risk landscape, ensuring that adequate coverage is available for affected communities.

How do building codes in Texas impact wildfire risk?

Building codes in Texas can significantly impact wildfire risk by mandating fire-resistant materials and construction practices. Modernizing these codes can help reduce vulnerability to wildfires, ensuring that new structures are better equipped to withstand fire threats and contributing to overall community resilience.

What is the government’s role in addressing wildfire risks in Texas?

The government plays a vital role in addressing wildfire risks in Texas by modernizing land-use policies, enhancing building codes, and investing in infrastructure to mitigate fire hazards. Moreover, effective legislation can help manage insurance challenges, ensuring that communities are resilient against future wildfire threats.

What strategies can homeowners adopt to reduce wildfire risks in Texas?

Homeowners in Texas can reduce wildfire risks by creating defensible space around their properties, using fire-resistant landscaping, and maintaining clear zones free of debris. Additionally, staying informed about local fire conditions and having an emergency plan in place can enhance personal safety during wildfire events.

How do Texas wildfire risks affect local economies and property insurance?

Texas wildfire risks can adversely affect local economies by decreasing property values and increasing insurance premiums. Insurers may adjust their coverage offerings based on the perceived risk, leading to challenges for homeowners in securing affordable insurance solutions in high-risk areas.

What advancements are being made in monitoring wildfire risks in Texas?

Advancements in monitoring wildfire risks in Texas include the use of sophisticated sensor networks, like those developed by Whisker Labs, which track environmental conditions and potential ignition sources. These technologies provide valuable data to help predict and prevent wildfire incidents more effectively.

| Key Points | Details |

|---|---|

| Smokehouse Creek Fire | The largest wildfire in Texas history, currently nearly contained but with potential for further spread. |

| Impact of Climate Change | Variability in climate-related threats necessitates updated risk management strategies from insurers. |

| Government’s Role | Need for modernization of codes and infrastructure investment to mitigate disaster risks. |

| Insurance Industry’s Response | Insurers use advanced data to assess climate risks and partner with various stakeholders to improve resilience. |

| Legislative Challenges | Proposed measures may worsen insurance challenges rather than address underlying risk valuation issues. |

Summary

Texas wildfire risks are an increasing concern as conditions remain ripe for new outbreaks even after significant fires like the Smokehouse Creek Fire. This situation highlights the urgent need for improved risk management strategies, updated infrastructure, and collaboration among insurers, government bodies, and communities to effectively mitigate the growing threats posed by wildfires in Texas.