How Life Insurance Can Secure Your Family’s Dreams

In a world filled with uncertainties, ensuring the future of your loved ones is a priority that cannot be overlooked. Life is unpredictable, and while we cannot control the twists and turns it takes, we can certainly be prepared for them. This is where life insurance plays a vital role. By securing a financial safety net, you not only safeguard your family’s dreams but also give them the peace of mind to live their lives fully, even in your absence. Understanding the various aspects of life insurance policies, whether it be term life insurance or whole life insurance, can empower you to make informed choices that align with your family’s needs and aspirations.

Main Points

- The importance of life insurance in protecting your family’s future.

- How different types of life insurance policies cater to various needs.

- Understanding life insurance benefits and their impact on your family’s dreams.

- Tips for finding affordable life insurance options.

- Making sense of life insurance quotes to choose the best plans.

Understanding the Importance of Life Insurance for Financial Security

In today’s unpredictable world, securing your financial future is paramount. This brings us to the pivotal role of life insurance. Many individuals often underestimate its significance, viewing it as an unnecessary expense rather than a crucial component of financial planning. However, understanding the intricacies of life insurance can change this perspective entirely.

Why Life Insurance Matters

Life insurance provides a safety net for your loved ones in the event of an untimely demise. This coverage not only ensures their financial stability but also helps in maintaining their lifestyle. With the proper policy, you can prevent your family from falling into financial turmoil during an already distressing time.

- Provides Financial Security: Life insurance offers a death benefit, which can replace lost income, pay off debts, or cover daily living expenses.

- Covers Final Expenses: Funerals and related costs can strain budgets. Life insurance can alleviate this burden.

- Peace of Mind: Knowing that your loved ones will be financially secure can provide immense psychological comfort.

Choosing the Right Policy

When contemplating life insurance, the options can be overwhelming. From term life to whole life, understanding the differences is essential for making an informed decision. The goal should always be to find the best life insurance plan that aligns with your financial objectives. Yet, affordability remains a crucial factor; thus, exploring various policies is advisable.

Many resources are available online to help you find affordable life insurance. Life insurance quotes can be easily obtained from different providers, allowing you to compare coverage options, premiums, and benefits effortlessly. But be wary of choosing a policy merely based on price; you must also consider the value it offers.

The Long-Term Benefits

Investing in life insurance can be one of the best financial decisions you ever make. It not only acts as a safety net but also provides a foundation for long-term financial planning. For individuals with dependents, the absence of life insurance can leave a significant gap in financial stability. In essence, life insurance embodies a responsible approach to financial security.

To summarize, understanding the importance of life insurance is not just about protecting your loved ones. It is about comprehensive financial planning that considers the unexpected twists life may throw your way. By taking the time to evaluate your options and find the policy that fits your needs, you are not just buying insurance; you are securing peace of mind for both you and your family.

How Life Insurance Can Serve as a Safety Net for Your Loved Ones

When contemplating the future, it’s essential to consider how you can protect your family’s financial well-being. Life insurance serves as a vital safety net, ensuring that your loved ones remain secure even in the face of unexpected loss. By providing a financial cushion, life insurance helps to mitigate the challenges that accompany such a profound event.

The Role of Life Insurance Policies

Life insurance policies essentially act as contracts between you and your insurer. You agree to pay premiums, and in return, your beneficiaries receive a predetermined sum upon your passing. This can significantly ease their financial burden, covering costs such as mortgage payments, education expenses, and daily living requirements. However, navigating the plethora of options can indeed be perplexing.

| Policy Type | Description |

|---|---|

| Term Life Insurance | This type offers coverage for a specific term, usually 10, 20, or 30 years. If you pass away during this period, your beneficiaries receive the payout; otherwise, the policy expires. |

| Whole Life Insurance | It provides lifelong coverage with the added benefit of accumulating cash value. This can serve as a resource for emergencies or future expenditures. |

Navigating Your Options

Choosing the right life insurance policy can indeed be daunting. While term life insurance is often more budget-friendly and straightforward, whole life insurance may better suit those looking for long-term security and savings. Each option carries distinct advantages, thus understanding your family’s needs is crucial.

Even so, it’s essential to assess your personal circumstances. Consider factors such as your age, health, and financial goals. Those with dependents might prioritize securing a significant payout, while individuals looking to accumulate savings might lean towards whole life options.

Conclusion: A Thoughtful Investment

In conclusion, life insurance undeniably serves as a safeguard for your loved ones during trying times. By examining the available policies—specifically term life insurance and whole life insurance—you can make an informed decision that aligns with your family’s needs. Ultimately, the peace of mind that comes from knowing your loved ones will be taken care of is invaluable. This thoughtful investment speaks volumes about your commitment to their future, showcasing that you are preparing for the unexpected with a loving heart.

The Role of Life Insurance in Fulfilling Your Family’s Long-Term Goals

When considering your family’s future, it’s natural to seek peace of mind. One of the most significant steps you can take in this direction is understanding how life insurance benefits play a crucial role in securing your family’s long-term goals. Imagine the reassurance that comes with knowing that your loved ones are financially protected, even when life takes unexpected turns.

Understanding the Importance of Life Insurance

At its core, life insurance serves as a safety net. It ensures that, in the unfortunate event of your passing, your family is not left struggling to meet their financial obligations. This is particularly vital if you are the primary breadwinner. The life insurance benefits can cover daily expenses, mortgages, and even future educational needs. However, it’s essential to remember that adequate coverage requires careful planning and consideration of various factors.

Aligning Life Insurance with Long-Term Objectives

Long-term goals often include buying a home, funding your children’s education, or even planning for retirement. Each of these dreams can be jeopardized by unforeseen circumstances, which is where life insurance becomes indispensable. It should not merely be viewed as a financial product, but rather as a transformative tool that fosters your family’s aspirations.

For instance, if you have children, you likely wish to provide them with the best possible education. A well-structured life insurance policy can ensure that funds are available for their college tuition should anything happen to you. By doing so, you not only meet their current needs but also empower them to pursue their ambitions without financial barriers. This alignment of life insurance with long-term objectives reflects a responsible approach to family welfare.

Navigating Common Misconceptions

Many individuals mistakenly believe that life insurance is only necessary for the elderly or those with significant financial responsibilities. However, this myth could not be further from the truth. Life insurance is most beneficial when it is secured early on, allowing you to lock in lower premiums and potentially increase your coverage later as your family grows and your financial responsibilities expand.

Additionally, some may think that the benefits of life insurance are only realized posthumously, which can lead to a lack of urgency in getting coverage. It’s worth noting that certain policies accumulate cash value over time, providing financial options while you are still alive. Thus, considering life insurance as part of your financial portfolio can be a strategic move.

Choosing the Right Coverage

Choosing the right life insurance is paramount to achieving your family’s long-term goals. Factors like your age, health, income, and specific goals should be considered when selecting a policy. Consulting with a financial advisor can help clarify your needs and lead you toward a policy that aligns perfectly with your objectives.

In conclusion, life insurance is more than just a financial contract. It is a vital component of a well-thought-out strategy to ensure your family enjoys financial security and fulfills their long-term aspirations. Ultimately, by recognizing the significance of life insurance benefits, you take a commendable step toward safeguarding your family’s future. Remember, it’s not just about being prepared; it’s about being proactive in creating a lasting legacy for those you cherish most.

Choosing the Right Life Insurance Policy to Secure Your Family’s Future

In today’s uncertain world, safeguarding your family’s future has become a priority for many. One of the most effective ways to achieve this is through a well-chosen life insurance policy. However, with numerous options and terms available, selecting the right coverage can be a complex and often overwhelming task. This article aims to guide you through the vital aspects to consider when making this important decision.

Understanding Life Insurance

To begin, it’s essential to grasp the fundamental meaning of life insurance. Essentially, it is a contract between you and an insurance provider, wherein the insurer commits to pay a predetermined sum of money to your beneficiaries upon your passing. This financial support can be crucial for your family’s stability, covering daily expenses, debts, and future educational requirements.

Types of Life Insurance Policies

There are various types of life insurance policies available. Understanding these can help you decide based on your specific needs. Here are the most common categories:

- Term Life Insurance: Offers coverage for a specific period, typically ranging from 10 to 30 years. If you pass away within this term, your beneficiaries receive the death benefit. However, if you outlive the term, the policy ends without any payout.

- Whole Life Insurance: Provides lifelong coverage and includes a cash value component that grows over time. This policy can be more expensive but serves as an investment for your future.

- Universal Life Insurance: A flexible policy that combines coverage and an investment savings element. You can adjust your premium payments and coverage amounts according to your changing needs.

Assessing Your Needs

Before embarking on your search for the ideal policy, assess your family’s financial situation and future needs. Consider the following factors:

- Dependents: Determine how many individuals depend on your income. The more dependents, the greater the coverage you’ll likely need.

- Debt Obligations: Account for any existing loans or mortgages. Your policy might need to cover these, ensuring your family’s financial security.

- Future Expenses: Think about potential future costs, such as college tuition for your children. Your life insurance should consider these long-term expenses.

Comparing Policies and Providers

Once you’ve identified your specific needs, the next step is comparing various policies and providers. Pay attention to the following elements when evaluating options:

- Premium Costs: Different policies come with varying premium structures. Make sure to choose one that fits comfortably within your budget.

- Coverage Amount: Ensure the policy provides an adequate coverage amount that aligns with your family’s future financial obligations.

- Policy Exclusions: Review the fine print to understand what is not covered by the policy. This knowledge is crucial for avoiding unpleasant surprises later.

Consulting with a Professional

Given the complexities of life insurance, consulting with a financial advisor or insurance agent can be beneficial. They can provide tailored advice based on your situation and help you navigate the myriad of options available in the market.

Final Thoughts

Choosing the right life insurance policy can significantly impact your family’s future security. By understanding the different types of policies, assessing your needs, and comparing options carefully, you can make an informed decision that provides peace of mind for you and your loved ones. Remember, life is unpredictable, but with the right preparation, you can ensure your family’s financial well-being no matter what happens.

Life Insurance as an Investment: Building Wealth for Generations

When most people think of life insurance, they often envision policies meant to cover unexpected expenses or provide financial security for loved ones after one’s passing. However, life insurance can also serve as a powerful tool for wealth building and intergenerational support. Understanding how life insurance functions as an investment can significantly alter one’s financial planning strategy.

The Dual Role of Life Insurance

At its core, life insurance is designed to offer security. But, in many cases, it also acts as a vessel for long-term investment. Whole life policies, for instance, combine a death benefit with a cash value component. This cash value accumulates over time and can be borrowed against or withdrawn, providing policyholders with a financial cushion during their lifetime. The dual nature of these policies allows families to not only protect against unforeseen events but also to build a savings vehicle that can grow steadily over the years.

A Strategy for Generational Wealth

Wealth building doesn’t end with one generation; it often requires a forward-thinking strategy. Life insurance can play a crucial role in this. As beneficiaries, children or grandchildren can inherit not just a death benefit, but also a financial foundation that can assist in education, property purchases, or starting businesses. This aspect of life insurance encourages smart financial habits and planning for the future, fostering an environment where wealth can be preserved and grown rather than dissipated over time.

Tax Advantages of Life Insurance

Another factor that adds to the appeal of using life insurance as an investment is its favorable tax treatment. The proceeds from a life insurance policy are typically received tax-free by beneficiaries. Additionally, the cash value that accumulates can grow tax-deferred. These tax advantages enable policyholders to maximize their wealth-building potential while minimizing the tax burden on their heirs.

However, Proceed with Caution

While the idea of using life insurance as an investment is enticing, it is crucial to approach this strategy with caution. Not all life insurance products are created equal. Some policies have high fees and may not provide the returns that traditional investments like stocks or bonds might. Therefore, thorough research and consultation with a financial advisor are essential. One should seek to find a policy that aligns with their financial goals while ensuring that it fits within their overall investment strategy.

Conclusion: A Holistic Approach to Financial Planning

Using life insurance as an investment clarifies its potential to not only protect loved ones but also build a lasting legacy. By understanding its multifaceted role, individuals can better plan for the future and create a sustainable wealth-building strategy. Ultimately, integrating life insurance into a broader financial plan could provide families with security, prosperity, and peace of mind for generations to come.

The Benefits of Life Insurance in Estate Planning and Wealth Transfer

In today’s financial landscape, incorporating life insurance into your estate planning strategy serves as a crucial element in ensuring the future well-being of your loved ones. Understanding how life insurance can facilitate wealth transfer is essential, yet many individuals often overlook its significance. It is not merely a safety net but a vital component that aids in minimizing potential financial burdens on heirs.

Securing Financial Stability for Heirs

One of the primary benefits of life insurance in estate planning is the provision of immediate liquidity upon death. This immediate financial support can provide your heirs with the necessary resources to cover outstanding debts, funeral expenses, and other financial obligations. With such a foundation, they may not need to liquidate valuable assets hastily, which could otherwise result in significant financial loss.

“Life insurance is not just about protecting the present; it’s about securing the future.” – Financial Expert

Tax Advantages in Wealth Transfer

Moreover, life insurance can significantly enhance the efficiency of wealth transfer. Typically, death benefits from a life insurance policy are not subject to income tax, thereby permitting beneficiaries to receive the full amount without any deductions. This characteristic makes life insurance an attractive option for enhancing estate values.

| Advantage | Detail |

|---|---|

| Immediate Liquidity | Heirs can access funds quickly for urgent needs. |

| Tax Benefits | Death benefits are usually not taxable. |

| Wealth Preservation | Ensures that assets remain intact for heirs. |

Facilitating Estate Equalization

Furthermore, life insurance is instrumental in estate equalization. In scenarios where one child inherits a family business or valuable assets, life insurance can provide an equivalent cash value to other heirs. This approach ensures fairness without necessitating the division of the physical assets, which could lead to disputes or dissatisfaction among heirs.

In conclusion, the benefits of life insurance in estate planning and wealth transfer are multifaceted. From providing liquidity to enhancing tax efficiency and promoting equitable asset distribution, life insurance deserves careful consideration. Ultimately, it is not merely a financial tool; it is a promise of security for future generations.

How Life Insurance Can Cover Unexpected Expenses and Debt

Life is often unpredictable, presenting challenges that can catch anyone off guard. Unexpected expenses may arise, leading to financial strain and emotional stress. This is where life insurance steps in as a reliable safety net. By understanding how life insurance can be leveraged to cover unforeseen costs and debts, individuals can secure their financial well-being and that of their loved ones.

The Role of Life Insurance in Financial Security

Ultimately, the primary function of life insurance is to provide financial support to beneficiaries in the event of the policyholder’s untimely passing. However, its utility extends beyond that. Life insurance proceeds can be directed towards settling debts and managing immediate expenses, thus alleviating the financial burden on grieving families. This aspect can be especially important when unforeseen bills manifest right when they are least expected.

Covering Unexpected Expenses

Unexpected expenses can come in various forms—from medical emergencies to urgent home repairs. Quick access to funds is crucial during these times. Here’s how life insurance can help:

- Medical Expenses: Life insurance can provide a lump sum that helps cover medical bills that accumulate during a serious illness or accident.

- Funeral Costs: The costs associated with burial or cremation can be substantial. Life insurance payouts can ease these burdens at a difficult time.

- Daily Living Expenses: Surviving family members may struggle to cover day-to-day expenses after losing a loved one, and life insurance can bridge that financial gap.

Managing Debt Through Life Insurance Payouts

Debt can be another stressor that may escalate after the loss of a family member. Life insurance can play a critical role in managing this debt. Here’s what to consider:

- Mortgage Payments: Life insurance proceeds can be used to pay off or continue making mortgage payments, ensuring that the family home remains secure.

- Credit Card Debt: Monthly credit card payments may become unmanageable. Life insurance can help settle these debts, providing relief and peace of mind.

- Educational Expenses: Families often want to ensure their children can continue their education without financial disruption. Life insurance can facilitate this by covering tuition fees or related expenses.

Conclusion

The unpredictable nature of life underscores the importance of being prepared for the unexpected. By leveraging life insurance effectively, individuals can safeguard their financial futures against both unforeseen expenses and debts. Ultimately, this proactive approach not only protects one’s financial interests but also provides a sense of security for families during challenging times. In a world where uncertainties abound, having a solid plan in place can make all the difference.

Exploring Different Types of Life Insurance: Term vs. Whole Life

When considering life insurance, individuals often find themselves pondering over various options. Among the most popular choices are Term Life and Whole Life insurance. Both types serve the fundamental purpose of providing financial security for your loved ones in the event of your passing. However, they cater to different needs and come with distinct features that merit a closer look.

Understanding Term Life Insurance

Term Life insurance is often viewed as the more straightforward of the two. It offers coverage for a specified period, typically ranging from 10 to 30 years. Should the policyholder pass away during this term, the designated beneficiaries receive a death benefit. This approach makes it a cost-effective choice for those seeking substantial coverage at lower premiums. However, it’s essential to recognize that once the term ends, so does the coverage.

Many individuals find themselves drawn to the affordability of Term Life. The lower premiums can make this option particularly attractive for young families or those with significant financial obligations, such as a mortgage. Yet, a common misconception arises; after the term, some believe they can simply renew their policy without consequence. This is where confusion can creep in, as renewal premiums might skyrocket based on the insured’s age and health status.

Whole Life Insurance: A Different Animal

In contrast, Whole Life insurance offers lifelong coverage. It provides a death benefit as well as a cash value component that grows over time. This element can serve as a savings mechanism, allowing policyholders to borrow against their policy or withdraw funds if needed. The premiums for Whole Life policies are generally higher but remain constant throughout the life of the policyholder.

Some potential buyers might wonder whether the additional cost is justified. As the cash value builds, it presents opportunities for financial flexibility down the line. However, critics often cite the lower investment returns compared to traditional investment options, which can create confusion regarding the optimal use of funds over time.

A Quick Comparison Table

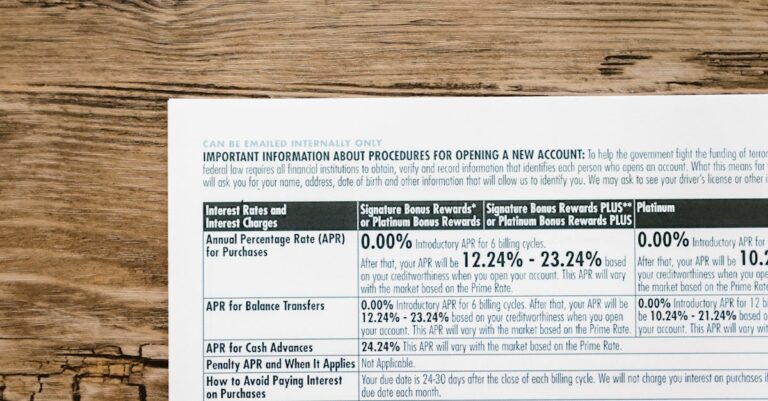

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Temporary (10-30 years) | Lifetime |

| Premiums | Lower | Higher |

| Cash Value | No | Yes |

| Ideal for | Temporary Needs | Lifetime Security |

Choosing the Right Option for You

The decision between Term Life and Whole Life insurance ultimately boils down to individual circumstances and priorities. It’s crucial to assess your financial situation, family needs, and long-term goals. For some, the simplicity and affordability of Term Life may suffice. Others might prefer the lifelong coverage and cash value benefits of Whole Life.

Furthermore, seeking guidance from insurance professionals can illuminate features you might not have initially considered. Thus, while the journey to selecting the right life insurance may seem daunting, understanding these foundational differences can empower you to make an informed choice. Always remember, the aim is to secure peace of mind for yourself and your loved ones.

The Emotional Peace of Mind That Life Insurance Provides

In an unpredictable world, where life seamlessly intertwines with uncertainties, the need for emotional security often becomes paramount. Life insurance, often seen merely as a financial product, transcends its conventional role. It offers an invaluable gift— the peace of mind that stems from knowing that loved ones will be supported, even when life takes unforeseen turns.

Understanding the Depth of Emotional Security

When we delve into the emotional landscape surrounding life insurance, it is essential to acknowledge its profound implications. It acts as a safety net, enveloping individuals and families in a cocoon of assurance. The mere thought of having a policy in place can alleviate tremendous stress. It reassures policyholders that, should the unexpected occur, the financial future of their dependents is safeguarded. This assurance can serve as a cornerstone for cultivating emotional stability.

Relieving Anxiety for the Future

Consider the typical worries that plague many individuals. Thoughts about their family’s financial future can often create a bitter taste of anxiety and dread. Would their children’s education continue? How would outstanding debts be managed? Here, life insurance plays a pivotal role. The prospect of leaving behind a safety net when one’s time comes can ease a heavy burden. While these concerns may appear distant, they can have a tangible effect on mental well-being.

The Struggle of Acceptance

Nevertheless, the decision to purchase life insurance can be daunting. There is an emotional labyrinth that many navigate, filled with internal debates and uncertainties. For some, facing the reality of mortality can be unsettling. Yet, through this struggle, clarity often emerges. Understanding that life insurance is not merely a preparation for death, but rather a testament of love and protection for the living, can change one’s perspective entirely.

Your Legacy – More Than Just Financial Support

The essence of life insurance extends beyond monetary relief; it encapsulates the lasting legacy one wishes to leave behind. It signifies a promise that no matter what happens, your loved ones will have the tools to thrive. This commitment can foster a sense of purpose, reminding you that you are crafting a narrative that will endure beyond your lifetime. Imagine the comfort this realization brings, not just to you, but to those you cherish.

Navigating the Choices

Ultimately, selecting the right policy involves careful consideration and open-hearted dialogue. Barriers such as confusion over types of coverage can add to the emotional stress. Will this policy be beneficial? How much coverage is necessary? These questions can swirl in one’s mind. Yet, approaching these conversations with a supportive spirit encourages a more profound understanding of not just the options available, but also of the emotional benefits tied to those decisions.

In conclusion, while life insurance may seem like an abstract concept, the emotional peace of mind it offers is distinctly palpable. By securing a policy, you can cultivate a nurturing environment for yourself and your loved ones. It becomes a tangible promise to safeguard their future, allowing you to embrace life’s unpredictability with much greater resilience. Balancing the complexities of life with such a profound assurance can indeed lead to a more fulfilling and less anxious existence.

Key Factors to Consider When Selecting Life Insurance for Your Family

Choosing the right life insurance for your family is a crucial decision that requires careful consideration. It’s not just about the financial aspects, but also about the peace of mind you gain knowing your loved ones are protected. In this discussion, we will explore the key factors to keep in mind when making this important choice.

1. Understanding Your Coverage Needs

Firstly, assess the financial responsibilities your family would face in your absence. This includes daily living expenses, mortgage payments, and education costs. By estimating these factors, you can better understand the level of coverage that would adequately protect your loved ones.

2. Types of Life Insurance Policies

There are primarily two types of life insurance: term and permanent. Term life insurance offers coverage for a specific period, often at lower costs. In contrast, permanent life insurance provides lifetime coverage and includes a cash value component. Each type has its advantages, so consider which aligns more closely with your family’s needs.

3. Premiums and Affordability

Next, examine the premiums associated with different policies. It’s vital to select a plan that fits within your budget without compromising essential coverage. Sometimes, opting for a longer term policy with a lower premium may be wiser than a more expensive permanent plan.

4. Health Considerations

Your health status plays a significant role in determining not only eligibility but also pricing. Insurers evaluate health records, lifestyle choices, and family history. A healthier applicant often benefits from lower premiums. If your health situation changes, it may become necessary to review your policy to ensure it still fits your family’s needs.

5. Beneficiary Designations

Designating beneficiaries correctly is crucial. It’s not just about naming individuals; it’s about ensuring your financial support reaches the right hands. Be transparent with your loved ones about these decisions to avoid any potential confusion or conflict later.

6. Riders and Additional Coverage Options

Insurance riders can enhance your policy by providing additional benefits or coverage. For instance, a disability rider can offer support if you become unable to work. Evaluating available riders may increase your policy’s effectiveness in protecting your family.

7. Researching Insurance Providers

Finally, take the time to research potential insurance providers. Look into their reputation, customer service, and claims process. Reviews and ratings can give you insight into how reliable a provider may be when your loved ones need to file a claim.

Conclusion

Selecting life insurance is a multifaceted process that requires attention to detail and an understanding of your family’s unique situation. By considering your coverage needs, exploring policy types, and evaluating other critical factors, you can choose a life insurance plan that provides robust protection for your loved ones.

| Factor | Importance |

|---|---|

| Coverage Needs | Determines necessary financial support for your family. |

| Type of Policy | Affects coverage duration and cost. |

| Premiums | Need to be affordable and align with budget. |

Ultimately, the security of your family is paramount. By delving into these key factors, you set the foundation for a responsible and thoughtful choice in life insurance.

Conclusion

How Life Insurance Can Secure Your Family’s Dreams. In the end, protecting your family’s aspirations starts with thoughtful planning. Life insurance stands as a safety net, ensuring that financial burdens do not overshadow your loved ones’ dreams. By investing in a life insurance policy, you provide a layer of security that can preserve their future, granting them the peace of mind needed to pursue their ambitions. This coverage can help cover educational expenses, support day-to-day living, or even allow for future investments. Ultimately, life insurance is not merely a policy; it is an expression of care and commitment to your family’s well-being. By taking this step, you embrace the role of a protector, allowing your family to thrive, no matter what life may throw their way. Remember, every dream deserves a chance, and life insurance can help ensure that chance is not lost.

Frequently Asked Questions

What is life insurance?

Life insurance is a contract between an individual and an insurance company that provides financial protection to beneficiaries in the event of the policyholder’s death.

Why do I need life insurance?

Life insurance helps provide financial security for your loved ones by covering expenses like mortgages, education costs, and other financial obligations in your absence.

What types of life insurance are available?

The main types of life insurance are term life insurance, whole life insurance, and universal life insurance, each offering different features and benefits.

How does term life insurance work?

Term life insurance provides coverage for a specified term, typically ranging from 10 to 30 years. If the policyholder passes away during this period, the beneficiaries receive a death benefit.

What is whole life insurance?

Whole life insurance offers lifelong coverage, as long as premiums are paid, and it also has a cash value component that grows over time.

Can I convert my term life insurance to whole life insurance?

Many term life insurance policies offer a conversion option that allows you to convert your term policy to a permanent policy, such as whole life insurance, without undergoing a medical exam.

How much life insurance do I need?

The amount of life insurance you need depends on your financial situation, obligations, and the needs of your dependents. A common rule of thumb is to have 10-15 times your annual income.

What factors affect life insurance premiums?

Factors affecting life insurance premiums include age, health, lifestyle choices (such as smoking), occupation, and the amount of coverage purchased.

Can I have multiple life insurance policies?

Yes, you can have multiple life insurance policies. Many people choose to combine different types of policies to meet their specific needs.

How do I choose the right life insurance policy?

To choose the right life insurance policy, assess your financial needs, compare policies and premiums, consider the term length, and consult with a financial advisor if necessary.